You may have missed it in the mainstream news media, but statistical societal indicators are reading red across the board. Before exposing the root causes of this breakdown, let’s look at some vital statistics and facts:

* The inequality of wealth in the United States is soaring to an unprecedented level. The US already had the highest inequality of wealth in the industrialized world prior to the financial crisis. Since the crisis, which has hit the middle class and poor much harder than the top one percent, the gap between the top one percent and the remaining 99% of the US population has grown to a record high.

* As the stock market went over the 10,000 mark and just surged to a 13-month high, the three big banks that took taxpayer money and benefit the most from the government bailout have just set a new global economic record by issuing $30 billion in annual bonuses this year, “up 60 percent from last year.” Bloomberg reported: “Goldman Sachs, the most profitable securities firm in Wall Street history, had a record profit in the first nine months of this year and set aside $16.7 billion for compensation expenses.” Goldman Sachs is on pace for the best year in the firm’s history, they are also benefiting by only paying 1% in taxes.

* The profits of the economic elite are “now underwritten by taxpayers with $23.7 trillion worth of national wealth.”

As the looting is occurring at the top, the US middle class is just beginning to collapse.

* Workers between the age of 55 – 60, who have worked for 20 – 29 years, have lost an average of 25 percent off their 401k. During the same time period, the wealth of the 400 richest Americans went up by $30 billion, bringing their total combined wealth to $1.57 trillion.

* Home foreclosure filings “hit a record high in the third quarter [of 2009]… They were the worst three months of all time… 937,840 homes received a foreclosure letter” in this three month period. “3.4 million homes are expected to enter foreclosure by year’s end, with some experts estimating that next year will be even worse.”

President Obama has enacted a $75 billion taxpayer funded program that has been a spectacular failure in stemming the foreclosure crisis and has proven to be another massive waste of billions of taxpayer dollars.

* 25 Million people are unemployed or underemployed.

This means we have 25 million people who urgently need to increase their income, and they’re quickly running out of options. The unemployment rate is expected to rise further and remain high for several years. “The president’s chief economic adviser warned that the nation’s unemployment rate could stay ‘unacceptably high’ for years to come.”

The NY Times reports: “Americans now confront a job market that is bleaker than ever in the current recession, and employment prospects are still getting worse. Job seekers now outnumber openings six to one, the worst ratio since the government began tracking…” As this ratio continues to grow, it will lead to a further reduction in wages – average worker wages have seen a sharp decline over the past year.

Economist Nouriel Roubini, a man who accurately predicted our current crisis, just reported on unemployment stating: “Think the worst is over? Wrong. Conditions in the U.S. labor markets are awful and worsening…. So we can expect that job losses will continue until the end of 2010 at the earliest. In other words, if you are unemployed and looking for work and just waiting for the economy to turn the corner, you had better hunker down. All the economic numbers suggest this will take a while. The jobs just are not coming back.”

* As the few elite banks thrive, there have been 123 US bank failures thus far this year. Recently, three banks that the government declared “healthy” and gave taxpayer money to have folded. The Wall Street Journal reports: “U.S. regulators have seized or threatened at least 27 banks that got capital infusions from the Troubled Asset Relief Program, including some lenders government officials knew were troubled when they awarded the money. The troubles put taxpayers at risk of losing as much as $5.1 billion invested in the banks since TARP was launched in October 2008.”

* As bankruptcies surge across the board, 10 US states are on the verge of bankruptcy, with several ready to declare a financial state of emergency. California, Arizona, Florida, Illinois, Michigan, Nevada, New Jersey, Oregon, Rhode Island and Wisconsin are all “barreling toward economic disaster, raising the likelihood of higher taxes, more government layoffs and deep cuts in services.”

This is occurring at a time when the “federal budget deficit for the fiscal year that just ended was $1.4 trillion, nearly a trillion dollars greater than the year before.” In total, “US public debt topped 12 trillion dollars for the first time in history… The public debt topped 10 trillion dollars in September 2008. The debt is quickly approaching the statutory limit of 12.104 trillion dollars, meaning Congress would have to raise the ceiling to prevent a shutdown of government operations.”

Economist Dean Baker explains the risk of running such a large deficit: “The debt limit must be increased at regular intervals in order to allow the government to function normally because the government is currently operating at a deficit. If the debt limit is not passed, then at some point the government will not be able to pay workers and contractors. It won’t be able to send out Social Security checks or make payments for Medicaid and unemployment insurance to state governments. And, it will not be able to make interest payments on government bonds, effectively defaulting on the national debt.”

Needless to say, all of this will make life drastically more difficult for citizens of the US. As the middle class continues on the path of economic decline, the number of citizens living in poverty has already hit an all time high.

* Although the government’s official figure tries to low-ball the number, 47.4 Million US citizens live in poverty, and the US poverty rate is the highest in the industrialized world.

Predictably, homelessness is rising at an increased rate as well. “The US government does not tally the numbers but interested organisations say that more than 3 million people were homeless at some point over the past year…. The fastest growing segment of the homeless population is families with children.”

Children have been hit especially hard by the economic crisis:

* 50% of US children, one out of every two children, will need to use food stamps to eat.

One out of every two children in the United States of America will need to use a food stamp… to EAT!

http://pubrecord.org/commentary/6084/critical-unraveling-society/

The money flow is clear:

* From taxpayers to AIG …

* From AIG and the Fed to big Wall Street investment banks like Goldman Sachs, and then …

* From Goldman Sachs to its employees in the form of lavish bonuses.

It is, by far, the greatest taxpayer rip-off off all time!

http://www.moneyandmarkets.com/the-biggest-rip-off-of-all-time-5-36544

What I do know for certain is that I am watching something that I never believed I would see in my lifetime. I am watching the collapse of my nation and my homeland. It is sort of akin to watching the Titanic sink, live, and no one can stop it from happening.

Just look around you. Even before the housing bubble, even before the capital markets fraud and Madoff Ponzi Schemes, even before the endless promises to end the Iraq and Afghanistan Wars, and even before the bailout of the Wall Street liars and thieves, it just keeps getting worse and accelerating. The lies keep getting more brazen and egregious. The actions are collectively worse each time this wantonly corrupt leadership pretends to lead.

The American Empire is collapsing and in a vain attempt to stop that our leadership has bankrupted America. The American economy is a carnival hall of smoke and mirrors. The economic engine has blown up and all of the 'robust' and 'green shoots' are idle words for numb-minded people hoping they can go back to shopping soon or maybe afford to turn their cable TV back on. That is if they have a home still to live in.

Most of the States are bankrupt. Mortgage foreclosures are now hitting a much wider segment of US society, including many people who have good paying jobs but are now being hit with mortgage rate resets. There is no stimulus in sight to create real jobs for real average American people. The economy at the local level has been left to tread water on its own as the wealthy elite and liars on Wall Street have been bailed out and huge bonuses lavished upon thugs with taxpayer dollars. Trillions of dollars of American citizen net worth has been wiped out, as well as the retirement security for tens of millions of Americans. The Dark Ages have just begun for America and it was all avoidable.

http://www.rense.com/general88/caca.htm

Hat tip to the Col. - Thank you!

Update 11/18/2009....

Great interview with Gerald Celente...this one is highly recommended

http://www.kingworldnews.com/kingworldnews/Broadcast/Entries/2009/8/14_Gerald_Celente_files/Gerald%20Celente%2008%3A14%3A2009.mp3

More from Celente...

Roughly 15 years ago – during the Clinton Administration [think Robert Rubin, Sir Alan Greenspan and Lawrence Summers] – between 1.3 and 1.5 million 400 oz tungsten blanks were allegedly manufactured by a very high-end, sophisticated refiner in the USA [more than 16 Thousand metric tonnes]. Subsequently, 640,000 of these tungsten blanks received their gold plating and WERE shipped to Ft. Knox and remain there to this day. I know folks who have copies of the original shipping docs with dates and exact weights of “tungsten” bars shipped to Ft. Knox.

The balance of this 1.3 million – 1.5 million 400 oz tungsten cache was also plated and then allegedly “sold” into the international market.

Apparently, the global market is literally “stuffed full of 400 oz salted bars”.

Makes one wonder if the Indians were smart enough to assay their 200 tonne haul from the IMF?

http://www.marketoracle.co.uk/Article14996.html

http://www.24hgold.com/english/news-gold-silver-zinc-dimes-tungsten-gold--lost-respect.aspx?article=2459973994G10020&redirect=false&contributor=Jim+Willie+CB

http://news.goldseek.com/GoldSeek/1258049769.php

http://news.goldseek.com/GoldenJackass/1243491300.php

Zero Hedge recently highlighted the developing risk in the government's outstanding Treasury portfolio, where nearly 40% of all issues mature within the year. As such the roll risk for the US government is massive, and even the smallest unexpected macro blip would make the rolling/refinancing of roughly $5 trillion in debt very problematic. Yet the US government is not alone in this quandary of how to keep T-Bill interest rates at record lows: an earlier report by Moody's demonstrates that the banking system is in far, far worse shape: "we note that average maturities of new debt issuances rated by Moody’s – which we use as an indicator of general trends -- fell from 7.2 years to 4.7 years globally over the last five years. This is the shortest average maturity for new debt at any given point during the 30 years of bank funding history covered by our analysis. As a related matter, we estimate that banks that we rate will face maturing debt of about $10 trillion between now and the end of 2015, $7 trillion of which will occur by the end of 2012."

Let's do the math: the US Gov't needs to roll about $6 trillion (and increasing) every year, Commercial Real Estate has a $3 trillion refi cliff around 2014 and the banking system has a $7 trillion roll maturity by 2012. In other words at or about 2012, or at the time Barack Obama is sure to be enjoying record approval ratings (high or low, your choice) courtesy of 30% unemployment, the American economy will be straddled with not just the ongoing burden of issuing about $2 trillion in debt each year to finance what can only be characterized as a budget concocted by the most hard-core, raving lunatics in the Federal Insane Asylum Reserve, but will have to deal with roughly $15 trillion of rolling maturities.

* One hears such sounds, and what can one say but... "Salieri"

* One fathoms such idiocy, and what can one say but..."Bernanke"

Full Moody's report for those who would rather see that the US economy is going to 10th circle of hell promptly, instead of buying Amazon stock at 1E10^18243 P/E, attached below.

http://www.zerohedge.com/article/us-lunatic-asylum-ie-economy-facing-approximately-15-trillion-roll-risk-2012

Bank analyst Don Coxe puts this in perspective for us:

A sustained U.S. economic recovery is unlikely until all banks, and not just the big institutions bailed out with government funds, start to recover from the effects of the financial crisis, according to longtime investment strategist Don Coxe.

Many banks that got funding from the government have seen their shares soar, while smaller, regional banks have not.

That’s a sign that investors believe the smaller banks are less well placed to participate in, and contribute to, the economic recovery, said the chairman of Coxe Advisors LLC in Chicago, who advises clients of the BMO Financial Group.

Think big banks – big business, small banks-smaller business. In effect, the credit flow for large multinationals is now back to normal. However, like consumers, small and medium-sized enterprises (SMEs) are finding a tougher reception. Revolving credit lines are being cut and loans are harder to come by (one reason Warren Buffett and Goldman Sachs are stepping into this space in this crucial holiday season).

http://www.creditwritedowns.com/2009/11/the-small-bank-big-bank-dichotomy.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+creditwritedowns+(Credit+Writedowns)

This evening Moody’s has placed under review for downgrade hybrid and subordinated debt totaling $450 Billion of securities.

Moody’’s Investors Service has placed under review for possible downgrade the ratings of 775 hybrid and subordinated debt securities issued by 170 bank families in 36 countries following a change to its rating methodology for these instruments.

The reviews follow the rating agency’’s announcement that it has changed the way in which it rates these securities to take into account the fact that some recent government interventions in troubled banks have not helped, and have even been to the detriment of, the holders of these types of securities. For example, in some cases, support packages have been contingent upon a bank’’s suspension of coupon payments on these instruments as a means to preserve capital.

I say again.. We keep being told that everything is getting better. This only shows more (not less) deterioration is taking place within the financial markets.

http://blog.rebeltraders.net/2009/11/18/more-debt-now-at-risk-of-downgrade-impacts-450-billion/

Job Losses Demystified

As the unemployment rate crossed the double digit barrier for the first time since Michael Jackson learned to moonwalk, President Obama announced that he will convene a “jobs summit” to finally bring the problem under control. Using all the analytic skill that his administration can muster, the President is determined to figure out why so many people are losing their jobs and then formulate a solution. That's a relief; for a while there, I thought we were in real trouble! In fact, the absolute last thing our economy needs is more federal government interference. If Obama really wants to know what's behind entrenched joblessness, he should start by looking at the man in the mirror.

Obama is pursuing, with unprecedented vigor, the same policies that have for decades undermined our industrial base and yoked us to an unsustainable consumer/credit driven economy. This doubling down on Washington's past failures is destroying jobs at an alarming rate. Today we learned that the September trade deficit surged by 18.2%, the largest gain in ten years. Much of the deficit resulted from Americans spending Cash-for-Clunkers stimulus money on imported cars – or “American” cars loaded to the sunroof with imported parts. In exchange for more domestic debt, we have succeeded only in creating foreign jobs.

An article in this week's New York Times by veteran writer Louis Uchitelle confirmed a fact that I have been alleging for years. Uchitelle pointed out that foreign outsourcing of component manufacturing has led to consistent overstatement of U.S. GDP and productivity. The connection goes a long way to explain why we keep losing jobs even as GDP is apparently expanding.

As our economy becomes less competitive due to higher taxes, burdensome and uncertain regulations, and capital flight, more manufacturing and services will be outsourced to foreign firms. However, the flaw in GDP calculation allows the output of those foreign workers to be included in our domestic tally. Since we count the output but not the worker responsible for it, government statisticians attribute the gains to rising labor productivity. To them, it looks like companies are producing more goods with fewer workers.

The reality is that we are producing less with fewer workers. The added “productivity” comes from higher unemployment and larger trade deficits. This is a toxic formula that will have lethal economic consequences.

Don't expect the brain trust at the President's job summit to fret much about these details. That public relations stunt will likely ignore the root cause of the economic imbalances and instead stress the need for government spending on training and education, i.e. more public debt. The unemployed do not need government theatrics, they need actual jobs. But as long as the government props up failed companies, soaks up all available investment capital, discourages savings, punishes employers, and chases capital out of the country, jobs will continue to be lost.

To really fix the unemployment problem, the President must look past his peers in government and academia to understand how jobs are actually created. In the private sector, all individuals have a choice to either work for themselves or someone else. Since labor is far more productive when combined with capital (office equipment, machinery, business models, and intellectual capital), those who lack these assets themselves often choose to work for others who have sacrificed to accumulate them. This increased productivity is shared between the worker and the owner of capital, and both are better off.

However, for one person or company to choose to offer a job to another, there must be an incentive to do so, and they must have the necessary capital. In the first place, employers must commit to paying wages and benefits, comply with government mandates and regulations, and subject themselves to potential lawsuits from disgruntled employees. All of these costs must be measured against the extra profits an employer hopes to earn by hiring an additional worker.

If profit opportunities exist, jobs will be created. Otherwise, they will not. Of course, anything the government does to raise the cost of employment, such as a higher minimum wage, mandated heath care, or greater regulatory burdens, not only prevents new jobs from being created but also causes many that already exist to be destroyed. Anything that diminishes the profit potential of extra hiring will diminish the number of job opportunities that are created. Also, since it is after-tax profits against which employers measure risk, the higher the marginal rate of income tax, the less likely employers will be able to hire.

Finally, in order to hire workers, employers must have access to capital to expand operations. Anything the government does to discourage capital formation automatically diminishes job creation. By running the largest federal deficits in history, Barack Obama is diverting all available capital to the Treasury, and is in effect waging a war against private capital formation.

If the President's summit truly intends to find the root cause of unemployment, his advisers don't need Bureau of Labor statistics or complex modeling software, just the courage to drop their dogmatic belief in central planning and embrace the laws of economics.

http://www.europac.net/#

The Pension Benefit Guaranty Corporation (PBGC) is the federal agency that guarantees pensions for 44 million Americans. The PBGC deficit doubled over the last six months to $22 billion ... but this is only just the beginning as the agency's potential exposure to future losses increased sharply.

http://www.calculatedriskblog.com/2009/11/pension-benefit-guaranty-corporation.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+CalculatedRisk+(Calculated+Risk

WASHINGTON— The Pension Benefit Guaranty Corporation (PBGC) ended fiscal year 2009 with an overall deficit of $22 billion, according to the agency's Annual Management Report submitted to Congress today. The result compares with the $11.2 billion deficit recorded at the previous fiscal year-end on September 30, 2008.

The deficit in the PBGC's insurance program for single-employer pension plans widened to $21.1 billion for the year, $10.4 billion more than the prior-year's $10.7 billion shortfall. The separate insurance program for multiemployer pension plans posted a deficit of $869 million, exceeding last year's $473 million shortfall by $396 million.

In an interim report to Congress in May, the agency showed a record deficit of $33.5 billion, based on unaudited numbers at the fiscal year mid-point on March 31.

The Annual Management Report classified 27 large pension plans with total underfunding of $1.64 billion as probable losses on the PBGC balance sheet. The report also shows that the agency's potential exposure to future pension losses from financially weak companies increased to about $168 billion from the $47 billion booked in fiscal year 2008.

"Exposure to possible future terminations means that we could face much higher deficits in the future," said Acting Director Vincent K. Snowbarger. "We won't fail to meet our obligations to retirees, but ultimately we will need a long-term solution to stabilize the pension insurance program."

http://www.pbgc.gov/media/news-archive/news-releases/2009/pr10-05.html

Still, agency executives stopped short of saying that a direct bailout would be needed. The F.H.A., which insures loans made by private lenders, guaranteed more than $360 billion in mortgages in the last year, four times the amount in 2007.

The results of the F.H.A.’s annual audit showed the agency’s capital reserves to be 0.53 percent, far under the 2 percent minimum mandated by Congress. A year ago, the capital reserves were 3 percent.

Nearly one in five loans made in 2007 are seriously delinquent, the agency said.

“FHA is playing a critical role in restoring health to the housing market by helping working families access mortgage finance when private capital is tight,” said Secretary Donovan. “This is a temporary role which FHA has played in previous economic downturns. The Administration is committed to ensuring that the FHA steps back as private capital returns to the market. With this temporary increased role comes increased risk and responsibility. That’s why we are committed to closely monitoring market behavior patterns and economic risks so that we are prepared to enact reforms that ensure the FHA’s financial health moving forward.”

In regards to Fannie Mae, does anyone even remember what their mission statement is? Here it is:

We are a shareholder-owned company with a public mission. We exist to expand affordable housing and bring global capital to local communities in order to serve the U.S. housing market.

Fannie Mae exists to expand affordable housing.

Is there any doubt Fannie Mae has failed the mission? The mission HAD to fail. The very act of government sponsorship of housing contributed to rising home prices. Every affordable home program in history has failed.

Finally, the FHA and the GSEs are both moral hazards. Should either blow up, risk is high there will be a bailout at taxpayer expense. Now there is talk in Congress of expanding the role of the both. Instead, both should be abolished. Neither Fannie Mae nor the FHA serves any purpose that cannot be served by the free market.

At the time I wrote that, Fannie Mae had not officially imploded. It has since done so.

The FHA is on the same path. It's just a matter of time, and probably not much time at that. An FHA bailout by taxpayers is on the way. There's no stopping it now.

http://globaleconomicanalysis.blogspot.com/2009/11/fha-bailout-by-taxpayers-on-way.html

From Bloomberg: Barofsky Says TARP ‘Almost Certainly’ Will Bring Loss

Neil Barofsky ... said the [TARP] will “almost certainly” result in a loss to U.S. taxpayers.

...

“Tens of billions of dollars are likely to be lost on the automotive bailout,” Barofsky said. In addition, some banks that received TARP money are failing, so the aid they received will be wiped out.

The TARP lost $2.33 billion on CIT and another $299 b million on the failure of UCBH Holdings (United Commercial Bank) last week.

And there are a growing number of banks not paying their TARP dividends (33 banks as of August - not all will fail, but that is a bad sign).

And this is the quote of the day:

“When I first took office, I can’t tell you how many times I’d be having a sit-down and warning about potential fraud in the program and I would hear a response basically saying, ‘Oh, they’re bankers, and they wouldn’t put their reputations at risk by committing fraud,’” he said.

“I think we’ve done a good job of instilling a greater degree of skepticism that what comes from Wall Street isn’t necessarily the Holy Grail,” he said.

http://www.calculatedriskblog.com/2009/11/tarp-inspector-general-taxpayers-to.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+CalculatedRisk+(Calculated+Risk

WASHINGTON — Consumers borrowed less for a record eighth straight month in September amid rising unemployment and tight credit conditions. Economists worry the declines in borrowing will drag on the fledgling recovery.

The Federal Reserve said Friday that borrowing fell at an annual rate of $14.8 billion in September. That's the biggest decline since July and was larger than the $10 billion drop economists expected.

Americans are borrowing less as they try to repair cracked nest eggs and replenish rainy day funds in a dismal jobs market. Many are finding it hard to get credit as banks, hit by the worst financial crisis in decades, have tightened lending standards.

Borrowing by consumers for revolving credit, including credit cards, fell at an annual rate of 13.3% in September, the same as August. This category has declined for a record 12 straight months.

http://www.usatoday.com/money/economy/2009-11-06-consumer-credit-september_N.htm

Update 9/15/2009....

The biggest and most secretive gathering of ships in maritime history lies at anchor east of Singapore. Never before photographed, it is bigger than the U.S. and British navies combined but has no crew, no cargo and no destination - and is why your Christmas stocking may be on the light side this year

You may wish to know this because, if ever you had an irrational desire to charter one, now would be the time. This time last year, an Aframax tanker capable of carrying 80,000 tons of cargo would cost £31,000 a day ($50,000). Now it is about £3,400 ($5,500).

This is why the chilliest financial winds anywhere in the City of London are to be found blowing through its 400-plus shipping brokers.

Between them, they manage about half of the world's chartering business. The bonuses are long gone. The last to feel the tail of the economic whiplash, they - and their insurers and lawyers - await a wave of redundancies and business failures in the next six months. Commerce is contracting, fleets rust away - yet new ship-builds ordered years ago are still coming on stream.

Do not tell these men and women about green shoots of recovery. As Briton Tim Huxley, one of Asia's leading ship brokers, says, if the world is really pulling itself out of recession, then all these idle ships should be back on the move.

'This is the time of year when everyone is doing all the Christmas stuff,' he points out.

'A couple of years ago those ships would have been steaming back and forth, going at full speed. But now you've got something like 12 per cent of the world's container ships doing nothing.'

Aframaxes are oil bearers. But the slump is industry-wide. The cost of sending a 40ft steel container of merchandise from China to the UK has fallen from £850 plus fuel charges last year to £180 this year. The cost of chartering an entire bulk freighter suitable for carrying raw materials has plunged even further, from close to £185,000 ($300,000) last summer to an incredible £6,100 ($10,000) earlier this year.

Business for bulk carriers has picked up slightly in recent months, largely because of China's rediscovered appetite for raw materials such as iron ore, says Huxley. But this is a small part of international trade, and the prospects for the container ships remain bleak.

Some experts believe the ratio of container ships sitting idle could rise to 25 per cent within two years in an extraordinary downturn that shipping giant Maersk has called a 'crisis of historic dimensions'. Last month the company reported its first half-year loss in its 105-year history.

Read more: http://www.dailymail.co.uk/home/moslive/article-1212013/Revealed-The-ghost-fleet-recession.html#ixzz0RBsRCJHY

Update 8/20/2009....

WASHINGTON (AP) -- With the recession throwing thousands of people out of work daily, more than 13 percent of American homeowners with a mortgage have fallen behind on their payments or are in foreclosure.

http://finance.yahoo.com/news/Mortgage-delinquencies-hit-apf-1442009590.html?x=0&sec=topStories&pos=7&asset=&ccode=

Update 6/27/2009....

The ongoing decline in tax receipts has worsened state budget problems. At least 48 states addressed or are facing shortfalls in their budgets for the upcoming year totaling $166 billion or 24 percent of state budgets. New data show a majority of states expect shortfalls in 2011 as well. Aggregate gaps through 2011 likely will exceed $350 billion.

Most states start their fiscal year July 1 and have either adopted budgets for fiscal year 2010 or will do so shortly. In doing so, they have used federal stimulus dollars, cut spending, raised revenues, and drawn down reserves.

Indications are that the budgets taking effect July 1 will not long be in balance because of continually eroding revenues. As of the last week in June, two-thirds of the states have adopted budgets for 2010 and already 12 of these states face new shortfalls totaling $23 billion before the fiscal year has even officially begun. Combining those new shortfalls with the fiscal year 2010 gaps already addressed, and those faced by states that have not yet completed their budgets, the total amount for fiscal year 2010 is at least $166 billion.

The states’ fiscal problems are continuing into the next year and likely beyond. At least 29 states have looked ahead and anticipate deficits for fiscal year 2011. These shortfalls total $38 billion — 8 percent of budgets — for the 21 states that have estimated the size of these gaps by comparing expected spending with estimated revenues, and are likely to grow as more states prepare projections and revenues continue to deteriorate.

http://www.cbpp.org/cms/index.cfm?fa=view&id=711

NEW YORK (Fortune) -- Known for his early warnings on Bear Stearns and Lehman Brothers, analyst Martin Weiss of Weiss Research is now sounding the alarm about state of California municipal bonds.

In a new report, Weiss has some rather blunt advice for California muni investors: "Sell all California paper now!" His reasoning? California is facing a $24 billion budget gap with no obvious way to close it.

The state has appealed to Washington for a federal bailout, but it got a cool response from the Obama Administration. The next step is draconian cuts in state services and payroll, but Weiss says that will only deepen the "depression" in California, where the unemployment rate is 11.5%, by further cutting into tax revenue.

Asked to put odds on California defaulting on its $59 billion in outstanding general obligation bonds, Weiss doesn't hedge. "It's unavoidable," he tells Fortune.

A California default would be especially devastating for two reasons: Munis have generally been viewed as a safe haven and California is the nation's largest issuer of tax-exempt bonds. According to Morningstar, assets in California muni bond funds now total $46 billion -- with billions more of California bonds held in national muni funds and individual bond portfolios.

http://money.cnn.com/2009/06/25/pf/california_bonds_trouble.fortune/index.htm

Not limited to U.S.

Last week the Eurosystem performed a €442bn injection of one-year liquidity into the Euro Area banking system. They did this at the official policy rate - the Main refinancing operations (fixed rate) - of 1.00 percent, against the usual collateral accepted for Longer Term Financing Operations, effectively anything euro-denominated, not based on derivatives and rated at least BBB-. It was a fixed-rate tender, that is, the ECB was willing to meet any demand at the 1 percent interest rate, as long as eligible collateral was offered; 1121 banks participated in the operation.

You will not be surprised to hear that this was the largest one-day ECB/Eurosystem operation ever. Even more remarkable than its scale are the terms on which the one-year funds were made available. There can be no doubt that this operation represents both a subsidy and a gift from the Eurosystem to the banks that participated in the operation. I hope to clarify the distinction between a subsidy and a gift in what follows.

http://blogs.ft.com/maverecon/

Japan’s consumer prices fell at a record pace in May, adding to the risk that deflation will become entrenched and hamper a rebound from the nation’s worst postwar recession. Prices excluding fresh food slid 1.1 percent from a year earlier after dropping 0.1 percent in the preceding two months, the statistics bureau said today in Tokyo. It was the sharpest decrease since comparable figures were first compiled in 1971.

http://japanjapan.blogspot.com/2009/06/japan-consumer-sentiment.html

In short; the recession in Japan is beginning to push the economy into the dark hole it has spent nearly two decades trying to escape (and never really managed). The point here is not to harp about headline inflation and whether it will go up or down since we are clearly going to be in situation over the next couple of months in which headline deflation on an annual basis will skew the overall index downwards. But this is hardly the point since, as we can see, the core or core index is declining fast too which tells us that domestic demand pressures in Japan are clearly negative at this point in time and may remain so for as far as the eye of a trained economist should be willing to see.

http://clausvistesen.squarespace.com/

Update 6/27/2009....

NEW YORK (CNNMoney.com) -- One week and counting. An unprecedented number of states have only days left to pass their fiscal 2010 budgets.

At least 19 states are still hammering out their spending plans as the recession wreaks havoc with their finances and sparks fights between governors and lawmakers. If spending plans aren't approved, state workers may not receive their paychecks and some government offices may shut down.

Some 46 states end their fiscal years on June 30 and all but one require balanced budgets be adopted. States are struggling to close shortfalls totaling $121 billion for fiscal 2010 as the recession decimates tax revenues.

In some states, the leaders aren't even talking. Pennsylvania's governor and Senate Republicans, who have to close a $3.2 billion gap for the current year, are not negotiating on their budgets.

"There's been no significant movement on the budget," said Chuck Ardo, press secretary for Gov. Ed Rendell, who is prepared to cancel his African safari in August if the budget isn't set.

The governor's $28.4 billion budget seeks to raise the personal income tax rate by half-a-percentage point and draining the commonwealth's $750 million rainy day fund. Senate Republicans' $27.3 billion plan looks to cut spending on areas such as education and community revitalization.

California approved its budget in February, but lawmakers and the governor are now locking horns over how to solve a $24 billion shortfall before June 30. The legislature presented a budget proposal last week that includes $11.4 billion in cuts and $2 billion in revenue hikes, but Gov. Arnold Schwarzenegger dismissed it as a piecemeal approach full of gimmicks.

If a budget isn't passed in coming days, California will run out of cash and be forced to start issuing IOUs, Controller John Chiang said on Wednesday. The state faced a similar situation in February, but at that time it had the option of withholding $3 billion in state tax refunds.

Now, it doesn't have that cushion. Also, the shortfall is now nearly five times as large, forcing the controller to withhold payments to local governments for social services, private contractors, state vendors, as well as income and corporate tax refunds.

"Next Wednesday we start a fiscal year with a massively unbalanced spending plan and a cash shortfall not seen since the Great Depression," Chiang said. "The state's $2.8 billion cash shortage in July grows to $6.5 billion in September, and after that we see a double-digit freefall."

http://money.cnn.com/2009/06/24/news/economy/Clock_ticking_on_state_budgets/index.htm?postversion=2009062417

Update 6/18/2009....

State income-tax revenue fell 26% in the first four months of 2009 compared to the same period last year, according to a survey of states by the nonprofit Nelson A. Rockefeller Institute of Government.

The report, conducted by the public-policy research arm of the State University of New York, is one of the most up-to-date measures of how deep the recession is digging into Americans' wallets and, consequently, state coffers.

Withholdings from the first four months of 2009 were down 6.9% from the same period in 2008, signaling that "many people had a very bad start of the year" with lower salaries and wages, says Don Boyd, a senior fellow at the Rockefeller Institute.

The time span notably includes the April 15 deadline for filing taxes, a critical time for states to collect revenues.

The sharp decline was a rude awakening for many states, both because income tax is the main source of revenue and because the drop was deeper than expected. It was steepest in Arizona, South Carolina, Michigan, California and Vermont. Only Utah, Alabama and North Dakota posted gains.

Personal-income-tax collections were down by $28.8 billion between January and April of 2009, compared to the some period last year, in the 37 states surveyed. Nine states don't collect broad-based personal income taxes, while results for the others weren't available.

The plunge in income-tax revenue means some states may have to revise budget agreements for 2009-2010 and may still face gaping holes in 2011, when federal stimulus money runs out.

http://online.wsj.com/article/SB124527624327024867.html

Update 6/6/2009....

In his daily report yesterday, David Rosenberg had some pertinent things to say about deflation, not the least of which was debunking Melissa Francis' preconception that inflation is equivalent to commodity price increases. The key issue is the differential between absolute and relative price increases: in many ways the current inflation scare is even less moot than the panic in the summer of last year, when it became painfully obvious that neither retailers nor final-state manufacturers have pricing power (think excess capacity: if the manufacturing ISM is any indication, this pricing power is only going to get further obliterated in the coming months, eating away directly at the bottom line, and making the forward EPS ramp up even more of a mirage in the manufacturing sector; also worth pointing out that non-manufacturing ISM actually fell by 2.6% to 44.4%). For a full discussion of this topic, we refer readers to Rosie's June 5 "Breakfast With Dave" piece.

A more relevant observation is Rosenberg's presentation of the Household Debt-To-Net Worth ratio (chart below), which is currently at an all time high of 26%. Rosenberg estimates that depending on where this ratio normalizes (either the pre-bubble 20% level, or the long term average of 16%), it would involve a debt elimination of $3-5 trillion. This delta is simply too big to be absorbed by taxpayers: "A goodly chunk of this excess debt — bringing credit into realignment with the permanently new and lower level of household net worth — is going to have to be paid down (or defaulted on). This is the lingering deflation risk that the bond bears have yet to factor in."

But what about all the excess cash flooding the system? As has been discussed on numerous occasions, even with the Quantitative Easing cash factored in, we are now in a much worse place from a mortgage interest perspective, and with every incremental increase in far maturity yields, consumers lose additional household value in the form of home equity (if you couldn't sell your half a million dollar house when mortgages were 4.5%, good luck trying to do so at the same price at 5.5%). On the other hand, the stimulus spending focus on infrastructure projects (and an ungodly amount of pork spending) has little hope of creating absolute inflation pressures: rebuilding highways and bridges by retaining minimum wage contractors does nothing to facilitate wage increases, and the unemployment number rising ever higher simply indicates that anyone harboring thought of a raise in this employment-supply glutted environment will be sorely disappointed for a long, long time.

As for the money multiplier effect - just take a look at the latest excess deposit reserve number. That's right: $838 billion in cash which nobody has any interest borrowing. In fact, the latest consumer credit number jives perfectly with a reversion to the mean as expected by the chart above. The bottom line - the U.S. consumer does not buy Bernanke's belief (nor Wall Street's consensus of almost 50% who say that the Fed Funds rate will be higher than 0% in three months).

One last point worth noting out is the amusing lose-lose situation (as Rosenberg presents it) which the Fed has painted itself with regard to Treasuries: "if the Fed doesn’t step in and buy more government bonds, investors are going to conclude that there is not enough demand to absorb all of the new supply coming on stream. Yet, if the Fed were indeed open to the idea of expanding its bloated balance sheet further, then the ‘monetization of debt’ would cause the inflation-phobes to panic and sell their long-duration paper."

So yes, all in all an admirable effort by the fed to give the impression that debt is deflating, happily gobbled up by the equity market. Of course it all occurred on the back of a plummeting dollar. It is inevitable that this trend will reverse promptly once the U.S. finds itself in an increasingly more problematic trade vacuum, as Japan and Europe realize they actually need to export products. In the prisoner's dilemma game of monetizing debt, Bernanke and Obama have defected against every single player, without repercussions yet, and have already lost any potential benefit from this action. It is our belief, that the next round will see defections by all those who have realized the Fed is now acting purely for its own, unitary interest. Politically destabilizing events like the parliamentary crisis in the UK, the IMF bailout of Eastern Europe, and others will only accelerate a wave of monetary backlash against the US. Then at some point the coincident dollar revaluation combined with the increasingly more trigger-happy bond vigilantes, and the consistently deleveraging consumer will expose the debt deflation for the mirage it was, and the equity market which has been in its own little world for way too long will finally get reacquainted with gravity.

http://zerohedge.blogspot.com/2009/06/household-driven-deflation.html

Update 6/4/2009....

As economic conditions deteriorate and unemployment continues to soar, one in nine Americans are now on food stamps. Moreover, a staggering one of every six dollars of Americans' income is now coming in the form of a federal or state check or voucher.

One in Nine Americans on Food Stamps

According to the USDA One in nine Americans on food stamps.

One in nine Americans are using federal food stamps to help buy groceries as the country's deep recession forced another 591,000 people onto the federal anti-hunger program at latest count.

Enrollment jumped 2 percent to 33.2 million people in March, the fourth consecutive month that rolls hit a record, said the Agriculture Department. The average monthly benefit was $113.87 per person.

"It's tough out there for struggling families and will be for many months to come," Jim Weill, president of the Food Research and Action Center, said. In 20 states, as many as one in eight are on the food stamp program, according to the Food Research Center.

In all, government spending on benefits will top $2 trillion in 2009 — an average of $17,000 provided to each U.S. household, federal data show. Benefits rose at a 19% annual rate in the first quarter compared to the last three months of 2008.

"The increase in social spending is still relatively modest given the severity of the downturn," says economist Dean Baker of the liberal Center for Economic and Policy Research. "We're not France."

Adam Lerrick, economist at the conservative American Enterprise Institute, says the benefits' explosion will eventually lead to an economic crisis. "We've seen this movie before in many countries. It always has the same ending," he says.

Nevada, Michigan and California had the biggest per-capita increase in bankruptcy filings in May, according to AACER.

California is paying out so much for jobless benefits and collecting so little in payroll taxes that its unemployment insurance fund could be $17.8 billion in debt by the end of 2010, according to a new report from the state Employment Development Department.

This latest fiscal crisis won't immediately affect the 1.1 million Californians now collecting benefits because the state is using an interest-free federal loan to cover their checks.

But the state is supposed to repay that loan and restore its unemployment fund to solvency by 2011 - and right now, policymakers aren't sure exactly how to do that, or at what cost.

"The deficit that California looks like it is facing is staggering," said Bud Bridger, fiscal officer for the unemployment insurance program.

To rebalance the system and pay back the federal loan, lawmakers must raise payroll taxes on employers, reduce benefits for recipients, or both. In 2009 and 2010, the state expects to pay out $29 billion in benefits. It will collect just $11 billion.

Collectively this is a stunning series of problems, both nationally and locally.

California is $17.8 billion in the hole (and counting) on unemployment insurance but the legislature is not even looking at the situation because of more pressing problems and because the state is using an interest-free federal loan to cover benefits.

Excuse me but is this $17.8 billion deficit in addition to the $24 billion budget deficit? How the Hell is California going to pay that back and fix a $24 billion budget deficit that without a doubt will cause a massive increase in unemployment? Has anyone factored that in?

How can loans of $17.8 billion not be considered as part of the deficit that needs to be fixed? What about California pension promises that cannot possibly be met?

One final question: Are we France or does it just look like we're headed that way?

http://globaleconomicanalysis.blogspot.com/2009/06/benefit-spending-hits-2trillion-highest.html

Every first Friday of the month we look at the headline numbers from the Bureau of Labor Statistics: so many jobs were added or lost last month; thus, we deduce the economy to be growing or declining. But this is less than half of the story; we rarely- if ever- discuss what kind of jobs are involved. I believe this to be superficial analysis and highly misleading.

For example: a skilled auto worker making $30/hr is fired and gets a job tending bar at $7/hr plus tips. Are these two jobs equivalent? Of course not.

About two years ago ago I started looking at the wholesale disappearance of goods-producing jobs in the US versus the creation of lower-to-middle tier service sector jobs (leisure and hospitality, retail, healthcare and education).

I have now updated the chart presented in the original post; I think it speaks for itself (see below).

http://suddendebt.blogspot.com/2009/06/from-powerhouse-to-funhouse.html

WASHINGTON — The Federal Deposit Insurance Corporation indefinitely postponed a central element of the Obama administration’s bank rescue plan on Wednesday, acknowledging that it could not persuade enough banks to sell off their bad assets.

In a move that confirmed the suspicions of many analysts, the agency called off plans to start a $1 billion pilot program this month that was intended to help banks clean up their balance sheets and eventually sell off hundreds of billions of dollars worth of troubled mortgages and other loans.

Many banks have refused to sell their loans, in part because doing so would force them to mark down the value of those loans and book big losses. Even though the government was prepared to prop up prices by offering cheap financing to investors, the prices that banks were demanding have remained far higher than the prices that investors were willing to pay.

In a statement, the F.D.I.C. acknowledged that it had not been able to get banks interested in its so-called Legacy Loans Program. Scheduled to start later this month, the pilot program was aimed at selling off $1 billion in troubled home mortgages.

F.D.I.C. officials portrayed the change as a sign that banks were returning to health on their own.

http://www.nytimes.com/2009/06/04/business/04bank.html?_r=1&ref=business

Consumer and commercial bankruptcy filings are on pace to reach a stunning 1.5 million this year, according to a report from Automated Access to Court Electronic Records.

In May, the number of bankruptcy filings reached 6,020 a day, up from 5,854 in April, AACER says.

More debt-laden consumers are turning to consumer credit counseling services for assistance. But credit counselors say that it's harder than ever to help them.

"People are coming to us in much worse shape than they used to be," says David Jones, president of the non-profit Association of Independent Consumer Credit Counseling Agencies. "We used to be able to help 20% to 25% of people who came to us, and now we can only help 7% to 8%."

Even the commercial bankruptcy rate is soaring, driven by shrinking sales and tight credit markets.

Last month, commercial filings hit 376 a day, up from 255 in May 2008. Hartmarx, which manufactures and markets apparel, and Silicon Graphics, a manufacturer of computer workstations and storage products, were among the filers.

The wave of corporate bankruptcies will cause a secondary wave in consumer filings, says John Pottow, University of Michigan bankruptcy law professor.

Bankruptcy filings are not climbing at the same rate in every state. Nevada, Michigan and California had the biggest per-capita increase in bankruptcy filings in May, according to AACER.

"Nevada doesn't surprise me," Pottow says. "It is ground zero of the housing crisis."

And California also has suffered from the boom and bust of the housing market. By contrast, Michigan is dealing with the collapse of the auto industry.

The recent bankruptcy filings of Chrysler and General Motors, along with plant closings and job losses, will spark even more consumer bankruptcy filings, Pottow says.

http://www.usatoday.com/money/economy/2009-06-03-bankruptcy-filings-unemployment_N.htm

The study found that medical bills, plus related problems such as lost wages for the ill and their caregivers, contributed to 62% of all bankruptcies filed in 2007. On the campaign trail last year and in the White House this year, Obama had cited an earlier study by the same authors showing that such expenses played a part in 55% of bankruptcies in 2001.

Medical insurance isn't much help, either. About 78% of bankruptcy filers burdened by healthcare expenses were insured, according to the survey, to be published in the August issue of the American Journal of Medicine.

"Health insurance is not a guarantee that illness won't bankrupt you," said Steffie Woolhandler, one of the authors, a practicing physician and an associate medical professor at Harvard.

"Lots of health insurance comes with big co-payments, deductibles and uncovered services," she said. "So you can be insured and still end up with big bills. At the same time, even if you have good insurance through your employer, you can lose it if you get sick and can't work."

Most people who filed medical-related bankruptcies "were solidly middle class before financial disaster hit," the study says. Two-thirds were homeowners, and most had gone to college.

http://www.latimes.com/business/la-fi-medical-bankruptcy4-2009jun04,0,4193398.story

For bigger picture go here...

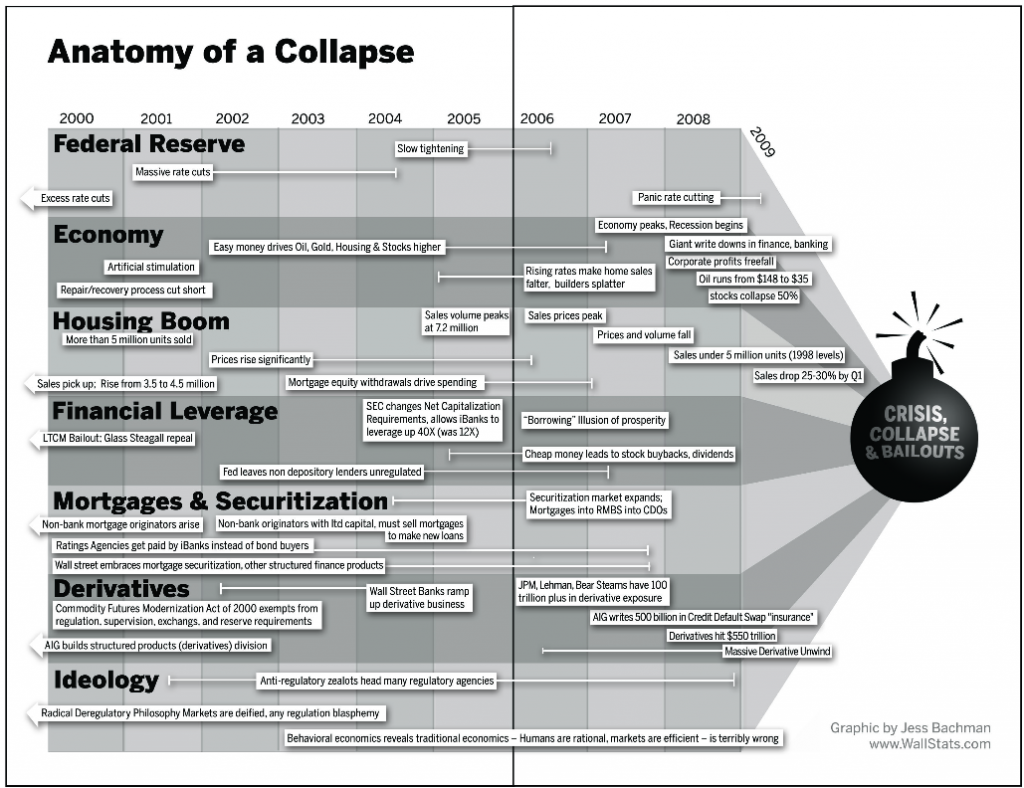

http://www.ritholtz.com/blog/wp-content/uploads/2009/06/anatomy-of-a-crash.png

Update 6/3/2009....

Half a million Americans lost their jobs in April, meaning there are now officially 14 million unemployed workers, the highest percentage in 25 years, and the strain on the unemployment system is beginning to show.

A compromise dating back to 1935 means each state has its own unemployment insurance system, with wide latitude to set taxes and benefit levels. As state systems buckle under the weight of skyrocketing unemployment, the fault lines of the current structure have been brought into stark relief.

States have been left on their own to financially founder or prosper, and benefits vary nearly as much as the health of state systems.

Fourteen states have simply run out of money to pay benefits and been forced to borrow from Washington a total of more than $8 billion. That number is almost certain to grow as more states reach the brink. If they are not able to pay that amount back before 2011, which most will not be able to do, they face paying hundreds of millions of dollars in interest.

Meanwhile, many workers are struggling to get by on what the system pays them. Where you live can make all the difference -- workers in the most generous states get twice the average benefits of workers in the stingiest ones. The percentage of unemployed workers who even receive benefits varies greatly by state.

Unemployment insurance is also intended to be automatic stimulus during a recession, keeping people spending and businesses open.

"The idea is you accumulate reserves and then you can support spending when the economy goes south," said Gary Burtless [3], an economist at the Brookings Institution.

But many states have failed to do that, and they're now paying the price. Indiana, which ran out of reserves last year, just raised its unemployment taxes by 35 percent, right in the middle of a deep recession when businesses can least afford it.

Other states did not plan as well. Many have been maintaining close to zero reserves [4] for years, well before the economy headed south. California, for example, got into trouble by raising benefits without increasing taxes. Other states, like Michigan, lowered taxes to unsustainable levels and watched their reserves dwindle.

Now, these states will be forced to raise taxes or cut benefits in the middle of a recession -- just when those changes will do the most economic damage.

Separate systems also mean state lawmakers must worry about the possibility of driving businesses out of their state -- into other states that may be undercutting them with unsustainable tax rates, said Doug Holmes of UWC — Strategic Services on Unemployment and Workers' Compensation, who has advised many states on unemployment insurance from a business perspective.

"It is a competitive environment, let's face it," Holmes said. "Each state doesn't operate on an island."

The amount of benefits disbursed to unemployed workers to boost their spending also varies widely.

In Massachusetts, the average unemployed worker gets $411 per week. In Mississippi, where Gov. Haley Barbour recently called unemployment taxes "a tax on job creation," it's $197. Of course, a buck goes further in Mississippi -- but not that much further.

On average, workers who rely on unemployment insurance get about half as much as they earned while they were working. In some states it is much less, and it may get lower as policymakers struggle to keep their unemployment insurance systems afloat.

There are also wide variations in the percentage of unemployed workers who collect benefits. Nationwide, only about 30 percent of workers who lose their job ever see an unemployment check, but in some states it is as high as 80 percent. Some of the variation is due to differences in who is allowed to collect benefits, some is because many workers -- particularly in states where unemployment insurance is considered a welfare program -- never apply.

http://www.propublica.org/feature/unemployment-insurance-is-not-working-603

(How do your state's benefits measure up? See our interactive chart [2].)

http://www.propublica.org/special/is-your-states-unemployment-system-in-danger-603

While the foundation is out of work and neck deep in credit cards wondering whether or not they'll have medical care for their fat, high fructose corn syrup addicted, rear ends....its brazen thuggery and robbery at its finest at the top....

Here's your "Holy crap!" moment for the day. It comes to us by way of Dakinkat at the Confluence and Mark Ames at Alternet, who have uncovered some more unsavory facts about Larry Summers, the noted sexist and former Harvard president who functioned as Clinton's Treasurey Secretary and who now directs Obama's National Economic Council. Ames poses the musical question:

Is Larry Summers taking kickbacks from the banks he’s bailing out?

Why did Goldman Sachs, Citigroup and Morgan Stanley steer millions to a company Larry Summers directed while he administered "stress tests" on them?

And do we now know the reason why those institutions survived the stress test in a better-than-expected fashion? Back to Ames:

Last month, a little-known company where Summers served on the board of directors received a $42 million investment from a group of investors, including three banks that Summers, Obama’s effective “economy czar,” has been doling out billions in bailout money to: Goldman Sachs, Citigroup, and Morgan Stanley. The banks invested into the small startup company, Revolution Money, right at the time when Summers was administering the “stress test” to these same banks.

A month after they invested in Summers’ former company, all three banks came out of the stress test much better than anyone expected -- thanks to the fact that the banks themselves were allowed to help decide how bad their problems were (Citigroup “negotiated” down its financial hole from $35 billion to $5.5 billion.)

http://cannonfire.blogspot.com/2009/06/inglorious-summers.html

City using goats to keep the grass down...

http://www.financialarmageddon.com/2009/05/a-different-kind-of-animal.html

GM bankrupt - stock at ZERO....

http://market-ticker.denninger.net/archives/1074-Told-Ya-So-GM-ZERO!.html

Excellent report from T2 Partners (New York Hedge Fund) on housing....

Grand Theft Auto: How Stevie the Rat bankrupted GM

Screw the autoworkers.

They may be crying about General Motors' bankruptcy today. But dumping 40,000 of the last 60,000 union jobs into a mass grave won't spoil Jamie Dimon's day.

Dimon is the CEO of JP Morgan Chase bank. While GM workers are losing their retirement health benefits, their jobs, their life savings; while shareholders are getting zilch and many creditors getting hosed, a few privileged GM lenders - led by Morgan and Citibank - expect to get back 100% of their loans to GM, a stunning $6 billion.

The way these banks are getting their $6 billion bonanza is stone cold illegal.

I smell a rat.

Stevie the Rat, to be precise. Steven Rattner, Barack Obama's 'Car Czar' - the man who essentially ordered GM into bankruptcy this morning.

When a company goes bankrupt, everyone takes a hit: fair or not, workers lose some contract wages, stockholders get wiped out and creditors get fragments of what's left. That's the law. What workers don't lose are their pensions (including old-age health funds) already taken from their wages and held in their name.

But not this time. Stevie the Rat has a different plan for GM: grab the pension funds to pay off Morgan and Citi.

Here's the scheme: Rattner is demanding the bankruptcy court simply wipe away the money GM owes workers for their retirement health insurance. Cash in the insurance fund would be replace by GM stock. The percentage may be 17% of GM's stock - or 25%. Whatever, 17% or 25% is worth, well ... just try paying for your dialysis with 50 shares of bankrupt auto stock.

Yet Citibank and Morgan, says Rattner, should get their whole enchilada - $6 billion right now and in cash - from a company that can't pay for auto parts or worker eye exams.

http://mwcnews.net/content/view/30937&Itemid=1

http://moremortgagemeltdown.com/download/pdf/T2_Partners_presentation_on_the_mortgage_crisis.pdf

Highlights on the report by Michael Shedlock (MISH)....lots of good insights into the debt load....

What can't be paid back will be defaulted on. Consumers with no job have no chance of paying back those debts. Many others who could, won't (because it is in their best interest to walk away). The Alt-A and Option ARM defaults are going to be massive.

Think this leads to inflation? Think again.

http://globaleconomicanalysis.blogspot.com/2009/05/mortgage-meltdown-more-pain-to-come.html

Jobs....

There have been job losses every month since December 2007. Moreover, there is no letup in sight as Continuing Claims Approach 6.8 Million, 17th Consecutive New Record.

The dip in initial claims from the March peak of roughly 650,000 is not accelerating very fast, if indeed at all. Those looking for a recovery in jobs soon are going to be disappointed.

Economists expect to see unemployment by 10% at the end of the year. I expect to see it at 9.8%+- by August and approaching 11% by the end of the year. Bear in mind the "stress-free tests" conducted by the Fed had an adverse scenario of 10.3% at the end of 2010.

The Decline from Peak Employment Now Exceeds the Past Five Recessions.

Bank losses....

Total Losses Are Now Estimated at $2.1-$3.8 Trillion – And Less Than Half of This Has Been Realized To Date.

http://globaleconomicanalysis.blogspot.com/2009/05/initial-unemployment-claims-dip.html

Cash strapped cities, states, and municipalities are increasingly looking to raise revenue by issuing tickets instead of cutting expenses.

JL writes ...

Hi Mish

I have had 3 different people tell me they got tickets from the CHP or San Francisco Police over the weekend. One ticket was written for having tinted windows. The officer in SF wasn’t even interested in the fact that the windows were tinted by the Audi Company and by regulation.

On one section of 101, where it’s not “really a highway” the CHP were lying in wait behind bushes-in a multicar queue for a rapid rollover of wallets. The motherload, a carpool violation, was enforced en masse on the Bay Bridge on Friday prior to the holiday. That’s 300 bucks a pop and I saw about 6 tickets being written where normally I see about 2 a week being enforced.

Public enforcement of law is fine, but it’s pretty obvious that the authorities have more in mind this year. Click it or TICKET. As if it’s really a big problem these days!

The February issue of Car and Driver includes a story describing how many jurisdictions are giving more traffic tickets as a revenue booster during tough financial times.

In Texas, to my mind, we've already taken this strategy about as far as it can go, to the point that, right now, more than 10% of Texas adults have outstanding arrest warrants - mostly for traffic tickets.

Dallas County represents perhaps the most extreme example of this trend in Texas. According to the Dallas Morning News ("Dallas county to vote on withholding vehicle registrations for those who owe fines," Feb. 9), "Unlike most counties, Dallas County gets slightly more than half of its annual revenue from fines and fees. Other counties rely more heavily on property-tax revenue."

Now Dallas plans to step up the pressure on even more on folks who can't or don't pay traffic fines, denying vehicle registration to drivers with outstanding traffic tickets. Again, we're talking about more than 10% of the adult population!

In addition, traffic "eyes" are sprouting up everywhere near where I live. Is this making anyone safer? I doubt it. Then again it's not supposed to. Moreover, it's so out of hand that 10% of Texans in some major cities have arrest warrants. How's that for complete insanity?

http://globaleconomicanalysis.blogspot.com/2009/05/click-it-or-ticket-insanity-10-of.html

Expect this trend to continue as budgets are sucked dry...let's see investigate a robbery or write traffic citations....3 citations a day will pay the officer's salary.....citations it is...

Homeowners from New York to Florida and in the Gulf Coast region are again seeing premiums rise and coverage change. And more are being dropped completely by their carriers as insurers try to limit their exposure in high-risk areas.

"They just don't like being in the business ... too much risk," said Scott Hall of Market Street Advisers, a financial advisory firm in Wilmington, N.C.

Homeowners' insurance premiums are up about 3 percent nationwide and probably more in some coastal areas where the potential for damage is greater, according to the Insurance Information Institute, a New York-based industry group. The hurricane season starts Monday and runs until Nov. 30.

Several factors are affecting premiums and coverage, including the $26 billion insurers paid out on catastrophic losses last year and the impact of financial market turmoil on the companies' earnings. Changes in state regulations are also driving some premiums higher.

Late last year, Allstate Corp. and State Farm Insurance Cos., two of the nation's top home and auto insurers, raised premiums in states including Texas, saying the increase was needed to offset a rising number of claims. Hurricanes Gustav and Ike hit the U.S. in September.

Northbrook, Ill.-based Allstate also implemented policy changes that raised deductibles and stopped offering coverage in high-risk coastal areas including downstate New York.

Meanwhile, State Farm Florida, a subsidiary of the Bloomington, Ill.-based insurer, is trying to pull out of the Florida market after the state denied the company's request for a 47 percent rate hike. Company officials have said they need the increase to remain financially viable. Discussions with regulators are continuing.

Shawna Ackerman, who co-chairs the American Academy of Actuaries' property and casualty extreme events committee, said she has not heard of any mass non-renewals or existing policy changes that are in the works for 2009. But insurers are continuing a process that began after they paid out $23.7 billion in claims -- a number adjusted for inflation as of 2008 -- on Hurricane Andrew in 1992, trying to limit their exposure, or vulnerability to losses, in coastal areas.

Hurricanes Ivan in 2004 and Katrina in 2005 forced several to pull back further, with many companies re-evaluating policy coverages and raising rates. Ivan caused more than $8.1 billion in losses after adjusting for inflation, while Katrina was the most costly, with losses now calculated at $45.2 billion, according to Insurance Information Institute data.

"Over the last five years, where we've seen record catastrophe losses in coastal areas -- Florida, Mississippi, Louisiana and Texas -- the increases in (premiums in) those areas have outstripped what we have seen nationally," said Bob Hartwig, the Insurance Information Institute's president.

Insurers will raise premiums wherever state regulators allow them to, Hartwig said. "In areas where they are not given that opportunity, insurers are going to scale back their exposure."

In 2007, Florida ranked as the state with the greatest hurricane exposure, facing a potential $2.46 trillion in losses, according catastrophe risk-modeling firm AIR Worldwide Corp. A close second, New York had $2.38 trillion in exposure; and third was Texas with $895.1 billion of exposure.

http://finance.yahoo.com/news/Anticipated-hurricanes-apf-15391201.html?sec=topStories&pos=3&asset=&ccode=

WASHINGTON -- After months of speculation, the time has come for life insurance companies to tap the government's bailout fund.

According to Treasury Department spokesman Andrew Williams, at least six insurers on Thursday were given preliminary approval to receive funds from the Treasury's Troubled Asset Relief Program: Prudential Financial ( PRU - news - people ), Lincoln National ( LNC - news - people ), Allstate ( ALL - news - people ), Principal Financial ( PFG - news - people ), Hartford Financial ( HIG - news - people ) and Ameriprise Financial ( AMP - news - people ). The companies had all applied for bank holding status by a deadline of Nov. 14 of last year, making them eligible to receive funding under a facet of the TARP that so far has allocated $218 billion to 532 banks.

Williams said via e-mail that the companies, like other firms that receive TARP money, "will be reviewed and funded as appropriate on a rolling basis." Only about $110 billion of the original $700 billion TARP remains on hand.

Like banks, insurance companies have been hamstrung by losses on their investments, and they need to meet minimum capital standards to be able to make payouts on their policies.

Although several firms had applied for aid, only one major insurer, American International Group ( AIG - news - people ), had been approved for TARP funding until now. Since last September, AIG has received some $180 billion in taxpayer funds because the government feared for the stability of the economy should the firm fail.

http://www.forbes.com/2009/05/14/insurers-tarp-treasury-business-washington-bailout.html

WASHINGTON, D.C. — Freight traffic on U.S. railroads during the week ended May 23 remained down in comparison with last year, although it did show an increase from the previous week this year, the Association of American Railroads reported today.

Property prices are down 32% So let’s take a closer look at US residential property prices which have been falling steadily for almost two years now. One of the better measures of that market is the Case-Shiller index. The index peaked in July 2006 and has since dropped by 32%. Now, in order to revert to the mean, US property prices must fall by about 40% or so in total. Therefore, with a bit of luck, those long suffering US home owners are about 75% of the way through the bear market.

But that is not the point I want to make. In December 2006, only a few months after the peak of the housing bull market, the total value of US residential property stood at $21.9 trillion. Prices have dropped by 31% since the end of 2006, so the estimated value today is about $15 trillion; however, the mortgage debt remains more or less unchanged and stands at $10.6 trillion. In other words, whereas debt-to-equity in the US housing market was 48% as recently as in December 2006, it is now 70% and will rise to 80% once house prices have mean-reverted.

Almost one-third of all US households have no mortgage. If you adjust for that, the 70-80% debt-to-equity ratio suddenly becomes a major challenge because it means that the two-thirds who do have a mortgage already face a debt-to-equity ratio in excess of 100%. Even worse, once the mean reversion has run its course, two-thirds of US households will be facing a debt-to-equity ratio of 120-125% on average.

US consumers are broke That is a shocking number and it blows a huge hole through the heart of the green shoots campaign so valiantly promoted by most of the mainstream media in recent weeks. The poorest two-thirds of US households are effectively broke, whether they realise it or not.

Obviously, households have assets and liabilities other than property and mortgages. Deutsche Bank has created a measure of liquid assets to liabilities which is illustrated in chart 2 below. As you can see, there has been significant damage done to households’ balance sheets in recent years. The first wave (2000-03) was mostly a function of the collapse of the dot com bubble. The second wave (2007- ) has come about as a result of the more recent collapse in property and share prices. It is probably fair to say that US households are more financially stressed than at any time since the Great Depression.

As DB points out in its report, households’ ability to spend is a function of three factors - cash flow (which again is driven mainly by income, mortgage rates and tax), credit (bank lending) and homeowner equity (property prices). Now, with negative equity against their main asset, with even more pressure on income as a result of the recession and with virtually no savings to cushion the pain, the majority of US households have no choice but to cut back drastically on their consumption. And with the US consumer being forced to pull back, the global recovery story turns very pale indeed.

Over the years I have learned never to underestimate the determination of the US consumer. He has always been prepared to spend his last dollar. Even when the tank was empty, he re-mortgaged his house so that the spending spree could continue a little longer. 70% of the US economy is accounted for by the consumer. That is more than 10% higher than the EU average (see table 1). Within the EU, only the UK comes close. But his options are running out. There can be no doubt that the party is well and truly over.

We need the US consumer! There is plenty of schadenfreude to detect here in Europe. Yet most of those people who argue that the American consumer has dug his own grave by acting so “irresponsibly” fail to understand that it is precisely the over-consumption in America which has driven the global economy to the lofty levels we have all come to like and enjoy. Without Americans being prepared to spend their last dime, there would have been no BRIC fairy tale and there would have been no German export boom, masking the fact that the domestic German economy has been on life support for a number of years now.

I could hardly believe my eyes and ears when, during the recent G20 summit in London, she declared that the German growth model would continue to be based on exports. To whom may I ask?

http://www.creditwritedowns.com/2009/05/green-shoots-or-smoking-weed.html?utm_source=feedblitz&utm_medium=FeedBlitzRss&utm_campaign=creditwritedowns

U.S. railroads originated 259,265 cars during the week, down 21.5 percent from the comparison week in 2008, but up 4.9 percent from the previous week this year. In comparison with last year, loadings were down 16.4 percent in the West and 28.0 percent in the East.

All 19 carload commodity groups were down from last year, with declines ranging from 4.8 percent for farm products other than grain to 59.7 percent for metallic ores.

Intermodal volume of 188,885 trailers or containers was off 19.1 percent from last year, with container volume down 14.2 percent and trailer traffic off 37.2 percent. Intermodal volume was up 0.2 percent from the previous week this year.

Total volume was estimated at 27.4 billion ton-miles, off 20.3 percent from 2008, but up 4.6 percent from the previous week this year.

http://www.ble.org/pr/news/headline.asp?id=26338

Wow, this sounds pretty good!

WASHINGTON -- U.S. banks reported a first-quarter profit of $7.6 billion, buoyed by revenue at a few larger companies, but overall the credit picture remained grim as the number of banks in trouble continued to rise and borrowers increasingly fell behind on their loans.

Or is it?

Let's think. During that quarter AIG passed through some $100 billion plus from the taxpayer to the largest of these very same banks.

So the banks "made" $7.6 billion, but they had an "unearned gain" of over $100 billion. Let's call it an even $100 billion as some of it didn't stay here in the United States.

Now The WSJ claims:

Still, the latest results were an improvement from the industry's net loss of $36.9 billion in last year's fourth quarter.

They were? I guess if you can count robbery as an "improvement", ok. But let's look at this from a different angle - back out that "unearned" and illicit gain from the passthrough and they would have lost $92.4 billion dollars, or well more than twice last year's fourth quarter.

Heh, if I can steal making my numbers is easy! All you have to do is leave the bank vault open and promise me that there are no guards, no cameras and no guns! I will then march in and steal whatever I want, and of course will turn in respectable quarterly results.

The problem with the banks lies here: